Get instant access to aggregated bank data from over 2,500 EU banks in an easy and compliant way.

Use cases

Open banking solution that fits any business

Coverage

Enjoy access to data from 2,500+ banks across the EU, with no technical effort

Aiming to offer businesses the finest coverage, we keep testing and adding new bank connections so you can enjoy access to data from any EU bank - anytime, anywhere and with no efforts from your side.

Salt Edge takes care of all technical, security and regulatory matters so you can focus on growing your success.

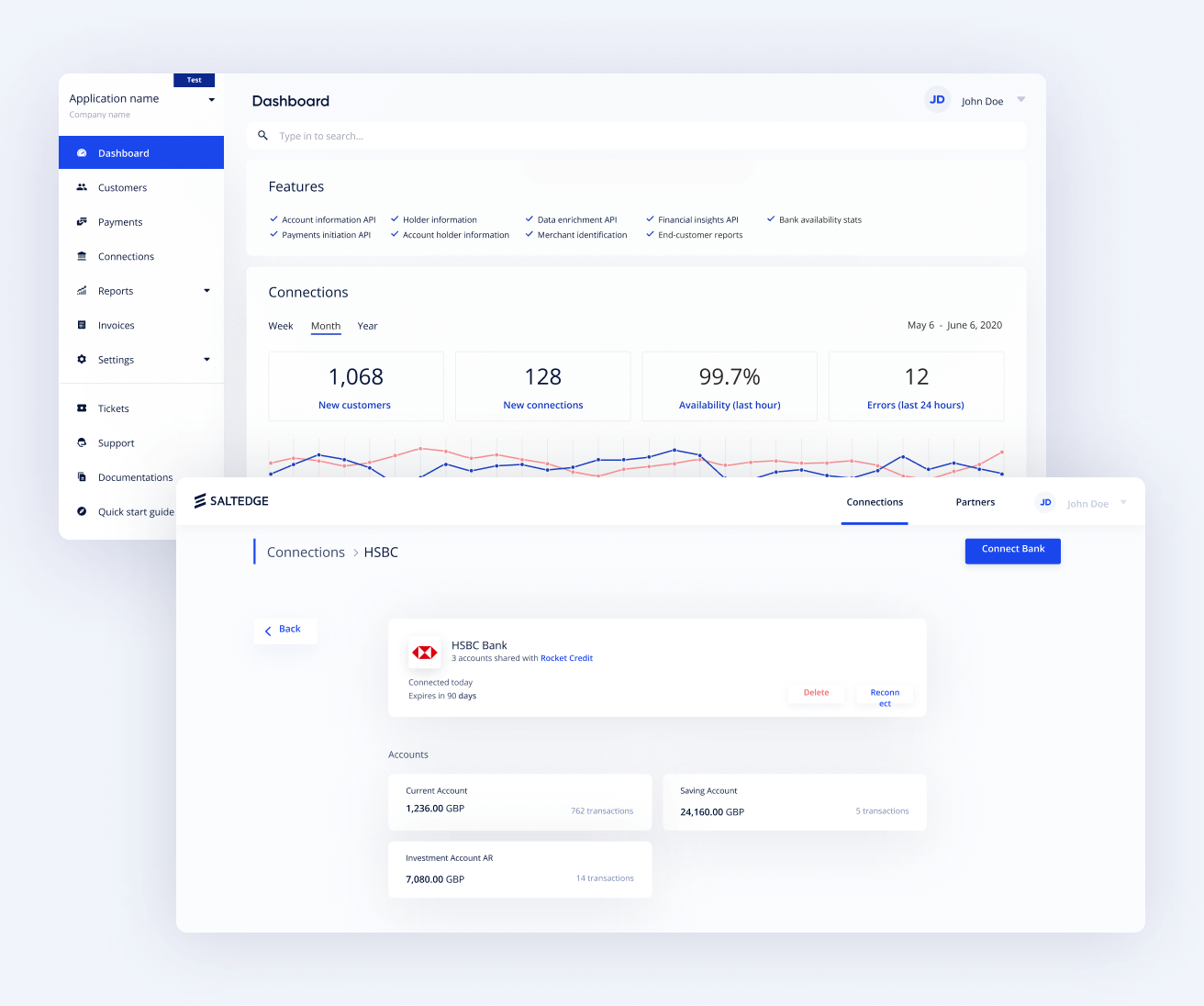

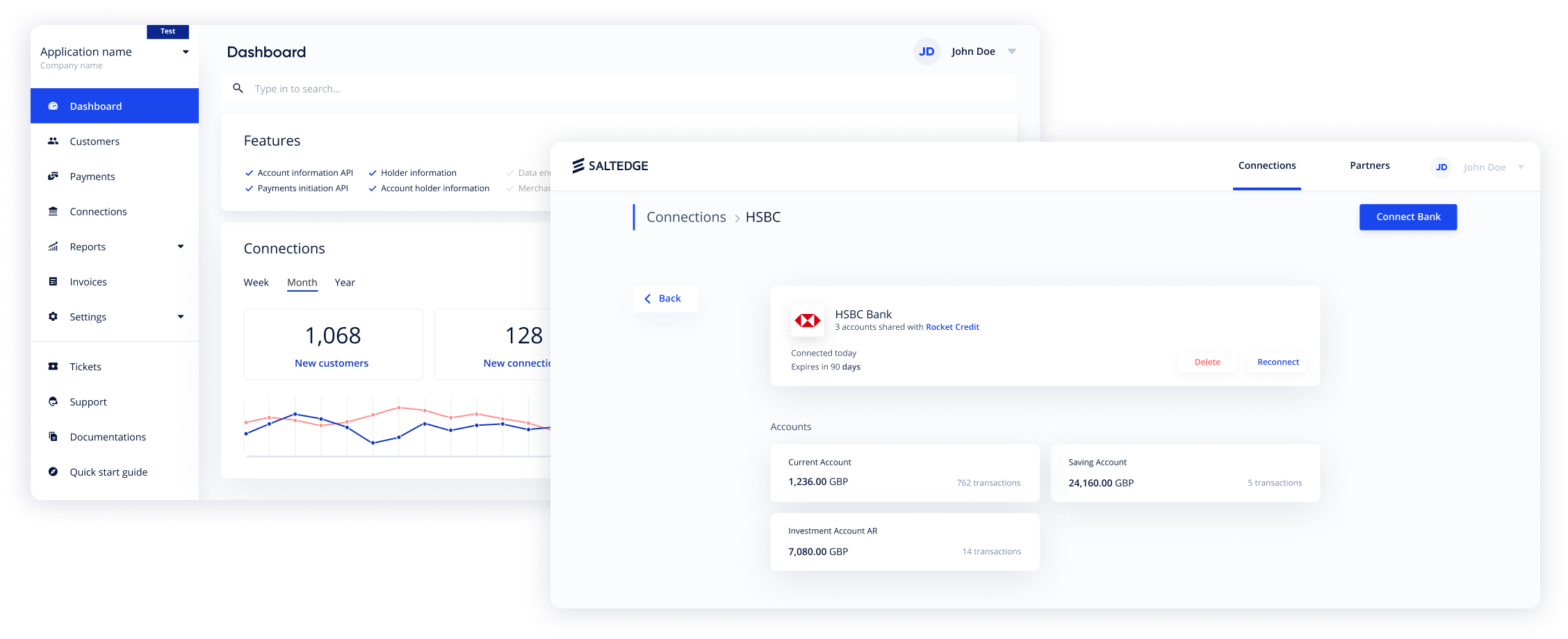

Set of dashboards

See at-a-glance the insights on connections and performance

The easy-to-use and intuitive set of dashboards include a comprehensive environment for companies and their customers that allow to get a full picture of conducted activities.

Dashboard for partners: Businesses can monitor all end-customers’ activity, granted consents, bank connections and their availability.

Dashboard for end-users: Customers can view the list of connected accounts, browse the granted consents and revoke them at any time. The existence and maintenance of this dashboard is mandated by PSD2.

The role-based access control and a built-in support channel grant secure, fast, and smooth communication between the parties.

Benefits

Unlock open banking data with minimal resources

Go live in 15 minutes

Curious? Start today!

Salt Edge’s ready-to-go solution helps to kit up your business with an innovative set of open banking tools to deliver a wide range of personalised and innovative services.

Handled by Salt Edge

Get PSD2 or open banking licence from national regulator

Handled by Salt Edge

Get eIDAS or OBIE certificates

Handled by Salt Edge

Onboarding with each EU bank

You’re one signature away

Sign the agreement with

Salt Edge

Ready? Go live!

Unlock the power

of open banking

They trust Salt Edge