Open banking benefits

Digital boost to business finance management

Open banking simplifies key processes for businesses, aiming to help them save countless hours that were previously wasted on accounting, billing and invoicing.

For accounting companies

Open banking-enabled accounting experience

Bank data feeds including KYC details, account numbers, and personal data from more than 5,000 banks in 50+ countries, directly to your software. The automation of bookkeeping and instant transaction processing ensure decreased operational costs, enhanced real-time reporting, and thus, capacity to serve more business clients. Get years of transaction history via one seamless integration in just several clicks and break free from Excel spreadsheets avalanche to increase productivity and decrease processing time.

For invoicing & billing service providers

Reduced administrative burdens

Create invoices in a blink of an eye with access to real-time bank data and autofill functions. Getting instant access to clients’ bank data in an easy and compliant way helps to automatise billing services: automatic import of transactions, simplify taxes calculations, account reconciliation, facilitate invoice fulfillment.

For business finance management (BFM) apps

Offer customised features based on data insights

Provide a quick overview of the company’s financials for efficient enterprise resource management. Create comprehensive reporting features to accurately measure business progress in real-time. With Open Banking Gateway, you can gain more information about the performance and patterns of their businesses.

For invoice payments (PISP)

Enable payment of invoices straight away

A digital makeover to invoice and reconciliation process by offering an affordable, faster and safer way of making and receiving payments directly from bank to bank, without extra transaction fees.

Client testimonials

A digital makeover to business finances via open banking

Meet some of the accounting and business finance management companies that are achieving exceptional results with Salt Edge.

Director of Product at FreshBooks

Nikhil Aggarwal

FreshBooks chooses Salt Edge to bring digital makeover to accounting via open banking

Salt Edge is PSD2 licensed and it covers all countries and many FIs in the EU. This collaboration allows us to continue servicing our customers in the EU. The biggest value this collaboration creates is that by connecting their bank and credit accounts to FreshBooks, our customers save a substantial amount of time as their bank transactions are imported automatically without manual data entry.

Chief Product Officer at Agicap

Maël Ezzabdi

Agicap opts for Salt Edge to digitalise cash flow management and forecasting for SMEs

Thanks to Salt Edge we help our customers to spend less time on managing their cash flows by giving them direct and real time access to all the financial data they need in one tool. Having access to reliable bank data, in real time, for each one of their entities is indeed crucial for CEOs and CFO in those tough times.

Co-founder at Finom

Alena Valovaya

Finom selects Salt Edge to simplify finance management for European SMEs

Our data aggregation system powered by Salt Edge is really something new. The way towards disruptive innovation is never easy, but we are sure that this is the right way to go. Entrepreneurs and professionals will love it because our product has been designed by the very same people who are supposed to use it.

Salt Edge toolbox

Why you should choose us

Coverage

Access the open banking data from 5,000+ financial institutions in over 50 countries with Salt Edge

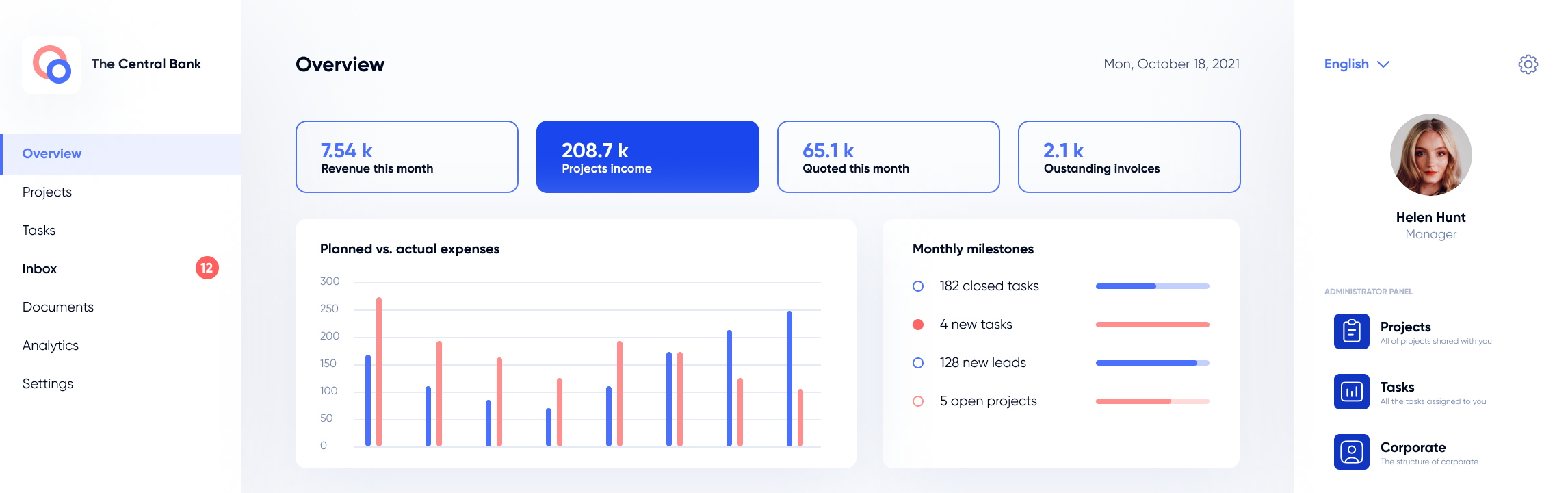

Set of dashboards

Get a comprehensive and user-friendly set of dashboards to see insights and monitor performance at-a-glance

Go live in 15 minutes

Choose the shortest path to discover countless open banking opportunities. Salt Edge handles all the technical, security, compliance matters for you

Data enrichment

Value-added services for complete financial behavior analysis: merchant identification, financial insights, business and personal transaction categorisation

Highest security standards

ISO 27001 certified and PSD2 licensed, Salt Edge employs the highest international security standards to initiate payments and access financial data

Instant payment

Pay by any bank from Europe, faster and more secure